In the coming weeks, a federal court will decide whether Google must break up parts of its adtech business. The Department of Justice argues that Google has too much control over the advertising supply chain—running tools for both buyers and sellers, while also owning the exchange in the middle. If the court orders changes, the way digital advertising is bought and sold could shift dramatically.

For businesses, marketers, and publishers, this ruling could change how ads are priced, how fees flow through the system, and which platforms hold the most influence. That’s why it’s important to understand how programmatic advertising actually works today.

Programmatic advertising sounds complicated, but at its core, it’s just how ads get placed automatically on your screen—whether that’s a display banner, a streaming TV spot, a pre-roll video, or even a podcast ad. Instead of humans making one-off ad buys, machines trade inventory in milliseconds.

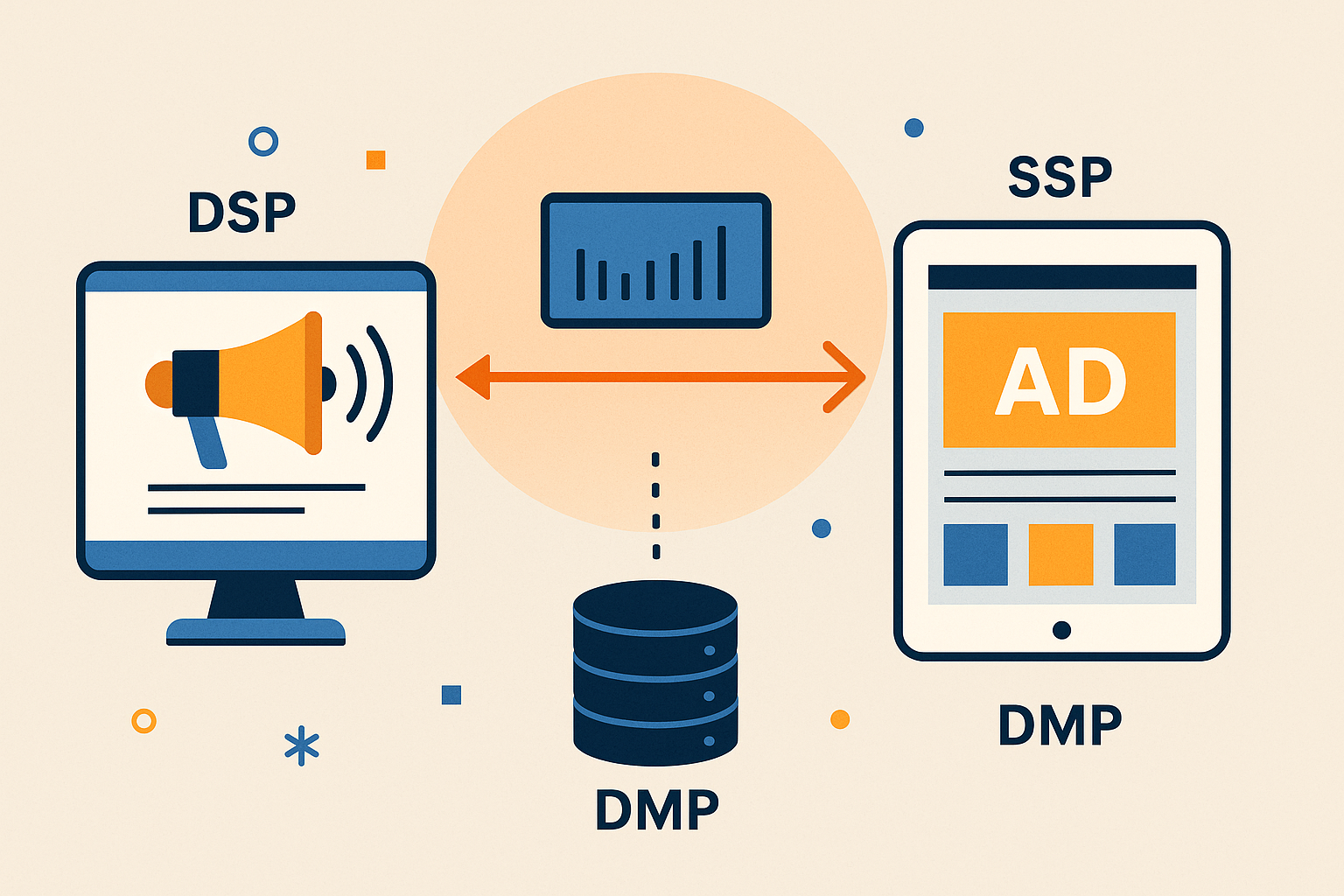

DSPs (Demand-Side Platforms):

Think of these as the shopping carts for advertisers. A DSP—like The Trade Desk or Google Display & Video 360—lets us buy ad space across websites, apps, connected TV, or streaming audio. They use real-time bidding to grab the best spots at the right moment, targeting by audience, interests, and behavior.

SSPs (Supply-Side Platforms):

If DSPs are the carts, SSPs are the digital shelves. Publishers—like news sites, apps, or streaming platforms—use SSPs such as PubMatic, Magnite, or Google Ad Manager to package up their available ad slots and sell them to the highest bidder.

DMPs (Data Management Platforms):

These are the brains in the middle. DMPs collect and organize data—demographics, browsing habits, purchase intent—so advertisers can target the right audience and publishers can price their inventory better.

How They All Work Together:

- You open a site or app.

- The SSP offers that open ad slot into an exchange.

- DSPs see it, run the data (often with help from a DMP), and decide how much to bid.

- The highest bidder wins.

- The ad is served—all in the blink of an eye.

The Fees and Layers:

Each platform takes a cut. Advertisers pay DSP fees, publishers give up a slice to SSPs, and everyone pays for the data that powers it all. The more layers, the more costs baked into each ad impression. That’s part of what regulators are watching in Google’s case: when one company owns too many of these layers—buying tools, selling tools, and the exchange in the middle—it can tilt the playing field.

Why this matters now: The DOJ wants Google to sell off its AdX exchange, arguing it has too much control over both sides of the market. Whatever the ruling, the decision will shape how programmatic ads—and the fees attached—work for brands and publishers.

What to Watch for After the Ruling:

- More Competition: If Google is forced to spin off parts of its adtech stack, we may see more independent players step in, creating new options for both advertisers and publishers.

- Fee Shifts: A breakup could lower the “tax” on each impression if competition forces platforms to reduce their cuts. On the flip side, it could also introduce new fees from smaller players filling Google’s void.

- Greater Transparency: Regulators want to shine a light on how auctions are run. If rules change, advertisers may gain clearer insight into where their dollars go and how bids are won.

- Added Complexity: For marketers, a breakup might mean juggling more vendors and technologies. What was once a one-stop shop through Google could become a multi-platform ecosystem that requires more management.

The coming decision will not just be a legal headline—it will shape the very plumbing of digital advertising. Understanding DSPs, SSPs, and DMPs now makes it easier to navigate whatever comes next.